Personal budget professional#

They do not necessarily reflect the opinions of National Bank or its subsidiaries.įor financial or business advice, please consult your National Bank advisor, financial planner or an industry professional (e.g., accountant, tax specialist or lawyer). These would all be considered your needs and should take up 50 percent of your budget. Start your budget by filling in the Your household section below.

Personal budget free#

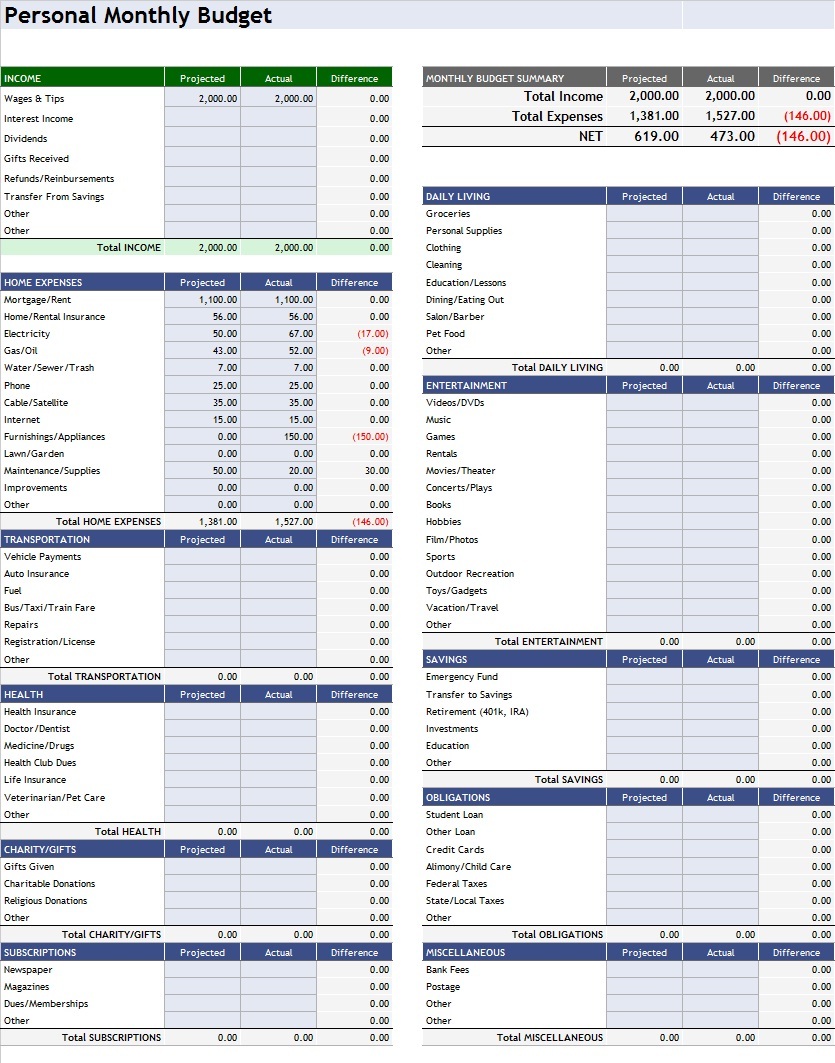

Our Free budget planner spreadsheet is both downloadable and printable. This free interactive budget is designed to help you to deal with your debts Use. Be 100 honest when filling in your answers remember its better to guess larger than smaller. Fill in the free BUDGET PLANNER spreadsheet. Views expressed in this article are those of the person being interviewed. See our six tips before starting your budget. The Bank cannot be held liable for the content of external websites or any damages caused by their use. The hyperlinks in this article may redirect to external websites not administered by National Bank. The details of this service offering and the conditions herein are subject to change. This article is provided by National Bank, its subsidiaries and group entities for information purposes only, and creates no legal or contractual obligation for National Bank, its subsidiaries and group entities. National Bank and its partners in contents will not be liable for any damages that you may incur from such use. The contents of this website must not be interpreted, considered or used as if it were financial, legal, fiscal, or other advice. Any reproduction, redistribution, electronic communication, including indirectly via a hyperlink, in whole or in part, of these articles and information and any other use thereof that is not explicitly authorized is prohibited without the prior written consent of the copyright owner. The copyrights on the articles and information belong to the National Bank of Canada or other persons. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. Your Future.Any reproduction, in whole or in part, is strictly prohibited without the prior written consent of National Bank of Canada. This sense of financial clarity is important, not only in college but throughout your life. Unexpected car problems or medical bills? That dream vacation your best friends invited you on? With a budget, you don’t have to panic or wonder if you have the money-you already know and have a plan ready to put into action. Creating a budget can also decrease your stress around finances. When you actually see the breakdown of your expenses, you may be surprised by what you find this process is essential to fully grasp how all of your spending decisions can impact you. Planning and monitoring your budget will help you identify unnecessary expenditures, allow you to adapt quickly if your financial situation changes, and make you more likely to achieve your financial goals. Regardless of what method you use or how much money you have to work with, a budget will help to keep you organized, give you a better idea of your financial situation, and allow you to feel more confident in the financial decisions you make. Budgets can be made using a spreadsheet, online tool, or just a pen and a piece of paper. A Personal Budget is an agreed amount of money that is allocated to you personally by your local council (and other funding streams) following an assessment. So how do you know if you can say yes to going out to eat or how much you can afford to pay in rent each month? By creating a spending plan through the use of a budget, you can start to make more informed decisions about your personal finances.Ī budget is an itemized summary of likely income and expenses for a given period of time. Simply put, it’s a breakdown of the money you will bring in and what you plan to do with that money over the span of a day, week, month, semester, or year. "Hey! You wanna go grab some take-out?" That's something you might hear a lot in college, and it's going to be tempting to say “Sure!” every time, but can you afford it? Now that you are living on your own, that’s a question you might find yourself asking more and more.

0 kommentar(er)

0 kommentar(er)